The worldwide insurance sector was one of the few to go against the grain and maintain an uptrend during the pandemic. It is expected to maintain robust growth in the coming years, despite a considerable displacement of funds occasioned by the digital transformation.

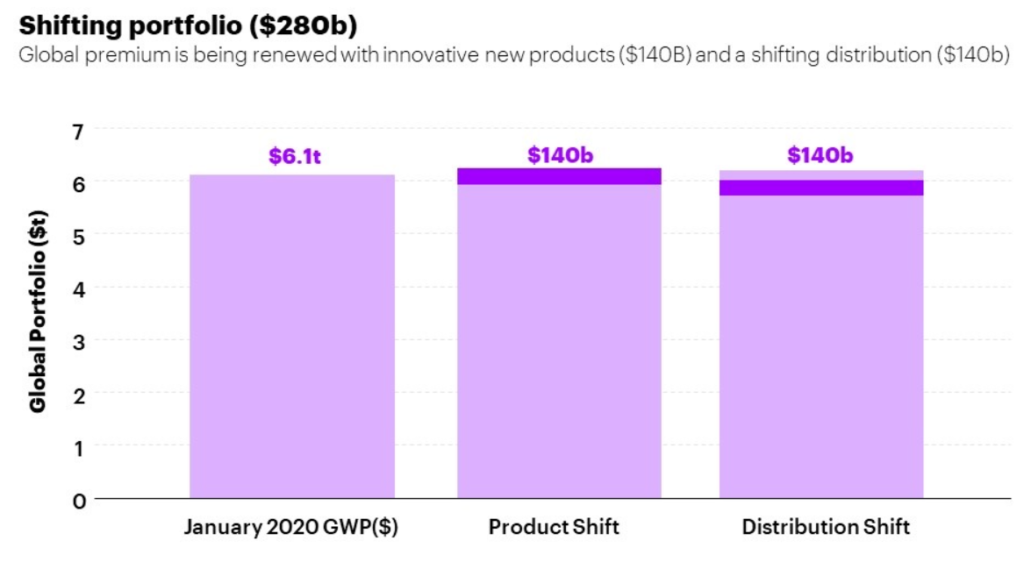

According to the research data analyzed and published by ComprarAcciones.com, the global insurance industry was worth $6.1 trillion in early 2020. The researcher projects that it will grow at a 3.5% compound annual growth rate (CAGR) to $7.5 trillion by 2025.

!function(e,i,n,s){var t=»InfogramEmbeds»,d=e.getElementsByTagName(«script»)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(«script»);o.async=1,o.id=n,o.src=»https://e.infogram.com/js/dist/embed-loader-min.js»,d.parentNode.insertBefore(o,d)}}(document,0,»infogram-async»);

The figure includes $800 billion in premiums from US healthcare payers. Traditionally, these figures are not included in the sector’s revenue. However, there has been an increase in demand for converging digital health services and products such as wellness products. This increase has made the figure more significant in the recent past.

Additionally, it is worth noting that due to the ongoing acceleration to digital channels, some traditional premiums might not be renewed. And this could completely change the revenue landscape in the future for insurers.

Per Accenture research, around $140 billion worth of current insurance revenue is likely to shift to technology-enabled insurance products. The switch is set to affect the insurance of smart homes and connected vehicles, triggering a shift to behavior-based models.

Traditional insurers could lose an additional $140 billion to insurers offering a digital distribution experience. This will come about as more and more customers buy insurance from third-party platforms and digital channels.

Overall, the industry is expected to remain resilient and keep growing. But to harness this growth, insurers will need to reimagine business operations and find ways to benefit from the digital shift.

Those who rapidly shift to technology-led offerings are likely to take the lead. Those who fail to do so risk losing out to new entrants and digital-first competitors.

Convergence of Health, Wealth and Life Insurance to Generate $120 Billion in New Revenue

Accenture highlights another opportunity for revenue growth from customer wellness. To benefit from this, insurers will need to make new partnerships to improve the personal finances and health of customers in a digital ecosystem.

!function(e,i,n,s){var t=»InfogramEmbeds»,d=e.getElementsByTagName(«script»)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(«script»);o.async=1,o.id=n,o.src=»https://e.infogram.com/js/dist/embed-loader-min.js»,d.parentNode.insertBefore(o,d)}}(document,0,»infogram-async»);

A convergence of the health and wealth industry with life insurance is forecast to generate an additional $120 billion in revenue. Smart health products will take center stage, contributing $60 billion to the total. Products and services for the aging population will account for $30 billion. Direct life and wealth management products will add the remaining $30 billion.

On the other hand, another new stream of revenue will come from newly developing risks. Under insurance covers for environmental disasters, climate change-related risks will contribute up to $50 billion in revenue.

The rise of cybersecurity threats will, in turn, lead to the generation of an additional $25 billion from risk mitigation services.

Essentially, these emerging risks will cause insurers to redefine their role from that of compensators to risk preventers. In the health sector, they will no longer be a financial safety net. Rather, they are likely to position themselves as active partners in loss and injury mitigation.

InsurTech Market To Grow at 48.8% CAGR between 2021 and 2028

Insurers need to take into account the rise of innovation in the insurtech sector as they improve on their business models. According to Digital Insurance, insurtech saw IPOs worth $33 billion and close to 250 private funding rounds in 2020.

!function(e,i,n,s){var t=»InfogramEmbeds»,d=e.getElementsByTagName(«script»)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(«script»);o.async=1,o.id=n,o.src=»https://e.infogram.com/js/dist/embed-loader-min.js»,d.parentNode.insertBefore(o,d)}}(document,0,»infogram-async»);

Based on data from Grand View Research, the insurtech market was valued at $2.72 billion in 2020. During the period between 2021 and 2028, it is expected to grow at an astounding 48.8% CAGR.

In a bid to keep up with the digital shift, insurance agents and brokers are increasingly investing in digital technologies. These investments allow them to offer services online and thus boost sales and increase margins.

A recent insurance digital transformation survey reveals that 39% of agents offer online portals. On these portals, customers can check payments and policy information, get insurance certificates and report claims among other things. 78% of agents are using Facebook to acquire new clients, while 68% are using LinkedIn.

The global market for insurance agents and brokers is projected to grow at a CAGR of 3.5% in 2021. Its value will increase from $350.4 billion in 2020 to reach $362.54 billion. In the period leading up to 2025, its CAGR will increase to 6%, driving the market’s worth to $457.31.

The growth is attributed to companies rearranging operations as they recover from the impact of the pandemic.

North America is the world’s biggest market for insurance agents and brokers, accounting for a 44% share of the global sector in 2020. Europe is the second largest, with a 31% share, while Eastern Europe is the smallest.

Question & Answers (0)