Chinese banks expect to initiate a recovery in 2021 following their first decline in a decade in 2020. According to the research data analyzed and published by ComprarAcciones.com, profits in the country’s banking sector as a whole fell by 1.8% last year based on preliminary statistics.

From Q1 2020 to Q2 2020, overall profits for China’s commercial banks sank by 9.4% year-over-year (YoY) to 1 trillion yuan ($146.2 billion). According to the China Banking and Insurance Regulatory Commission, the decline for the top six banks was even more pronounced, at 12%.

In the first nine months of the year, the decline for the overall sector stood at 8.3%. However, there was a remarkable 29% rebound during the fourth quarter, driving the final tally.

!function(e,i,n,s){var t=»InfogramEmbeds»,d=e.getElementsByTagName(«script»)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(«script»);o.async=1,o.id=n,o.src=»https://e.infogram.com/js/dist/embed-loader-min.js»,d.parentNode.insertBefore(o,d)}}(document,0,»infogram-async»);

The Q1 to Q3 drop was the first of its kind for some of China’s largest banks since the global financial crisis. It was as a result of higher loan loss provisions and an upsurge in bad debt.

Regulators also pushed financial institutions to forego a cumulative 1.5 trillion yuan ($212 billion) in profit for the year. In the first seven months of the year, they had already foregone 870 billion yuan in profit. The reason for this was to support the economy by deferring loan payments and lowering lending rates as well as fees.

The Chinese banking industry as a whole disposed of 3.4 trillion yuan ($490 billion) in bad loans in 2020. As a result, funds set aside as loan loss provisions during Q1 to Q3 surged to 5.1 trillion yuan from 4.5 trillion at the end of 2019. They covered 3.53% of outstanding loans up from 3.46% in the previous year.

ICBC Profits Surge by 35% in Q4 2020, Everbright by 38%, Ping An by 43%

According to Statista, the banking climate index dropped from 70.7% in Q4 2019 to 58.3% in Q1 2020. In subsequent quarters, it maintained an upward trend in tandem with the improving economic outlook. It rose to 63.9% in Q2, 66% in Q3 and 67.9% by Q4 2020.

!function(e,i,n,s){var t=»InfogramEmbeds»,d=e.getElementsByTagName(«script»)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(«script»);o.async=1,o.id=n,o.src=»https://e.infogram.com/js/dist/embed-loader-min.js»,d.parentNode.insertBefore(o,d)}}(document,0,»infogram-async»);

The index indicated that a rising percentage of institutions in the sector assessed that the sector was undergoing recovery.

Underscoring the optimistic outlook, Citigroup projects an increase of 4.5% for mainland-listed banks in 2021. In 2022, growth will rise by a further 6.5% and in 2023, by 6.8%.

Preliminary earnings reports for Q4 2020 from some of the country’s lenders highlight the ongoing industry recovery. For the Industrial and Commercial Bank of China, the quarter saw an upsurge of 35% in profits. Similarly, Everbright Bank posted a profit increase of 38%. Both banks attributed the growth to a decrease in bad loans and their growth rate was the highest on record since 2012.

Meanwhile, Ping An Bank had a profit upsurge of 43% during the quarter as a result of writing off bad loans and lowering credit costs. For the full year, its Insurance Group Unit had an increase of 2.6% in net profit and revenue growth of 11.3%.

!function(e,i,n,s){var t=»InfogramEmbeds»,d=e.getElementsByTagName(«script»)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(«script»);o.async=1,o.id=n,o.src=»https://e.infogram.com/js/dist/embed-loader-min.js»,d.parentNode.insertBefore(o,d)}}(document,0,»infogram-async»);

According to Citigroup, performance improvements in 2021 and beyond will result from a normalization of monetary policy. There will be less pressure to sacrifice profitability or cut loan prime rates. Fee incomes will also bounce back, surging by 7% in 2021 compared to 4% in 2020.

Clawing back some of the money set aside as loan loss provisions will also boost their balance sheets.

Global Bank Credit Losses to Increase by $1 Trillion between 2020 and 2022

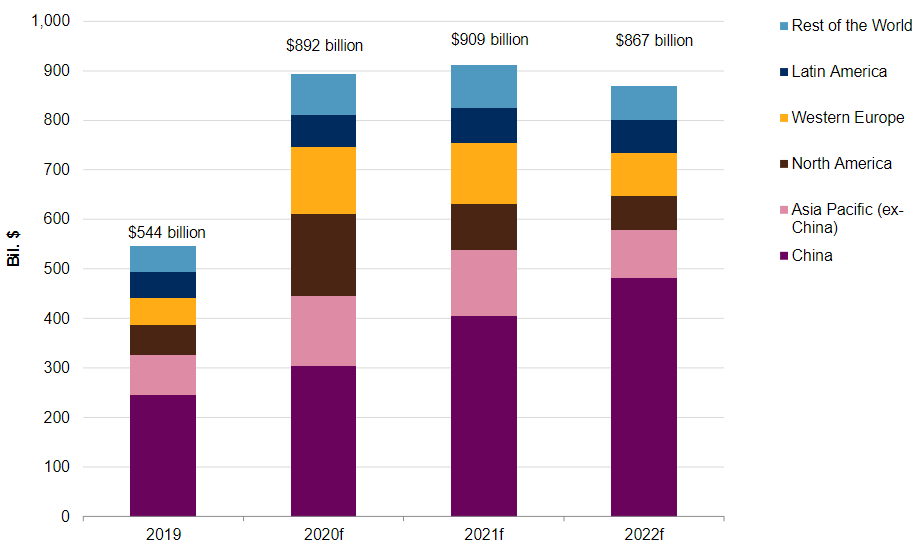

Unfortunately, the situation is not as rosy for the global banking sector. According to S&P Global estimates, the industry will suffer a cumulative credit loss of $910 billion in 2021. There will be a slight recovery in 2022 with total credit losses falling to $867 billion.

In July 2020, the source had forecast credit losses amounting to $1.8 trillion for the sector in 2020 and 2021. However, it reduced the projection by 15% in February 2021, reflecting changes in the industry.

Based on its report, final data from 2020 is expected to show credit losses totaling around $890 billion. That would be a third lower than the previous forecast, but it is still nearly two-thirds higher than the $544 billion reported in 2019.

However, the 2021 figure will be about 10% higher than the July 2020 forecast. The reason for this is that losses will be spread out over a considerable period.

Over the three-year period ending in 2022, there will be a cumulative increase of $1 trillion in credit losses for banks worldwide.

Question & Answers (0)