Following a rollercoaster 2020, the amount of VC funding flowing into Europe’s fintech sector seems set to reduce significantly in Q4 2020. The month of October saw a total of €367 million in VC investments into the region’s fintech.

According to the research data analyzed and published by Comprar Acciones, this funding was received across 44 deals that were publicly disclosed. Given that the 2020 monthly average funding value was €657 million, October was one of the lowest months this year.

The figure was nearly a fifth of the funding value seen in September, which saw a total of $1.7 billion. It was also remarkably low compared to the €1.1 billion that the sector received in October 2019.

A major reason for the slump was the fact that there were no deals surpassing €50 million during the period. The highest-valued deal was Primary Bid’s Series B funding round at £38.5 million followed by Lunar’s Series C, with £36.4 million. Knoma was third with a venture round valued at £19.1 million.

It is worth noting that the month was not all bad, as the number of transactions was at par with October 2019, which had a total of 45 deals. The consistency suggests that the pace of investment was normal. Furthermore, Europe saw a higher number of deals in the sector than Asia, which had a total of 26 deals according to Dealroom.

Notably too, there are a number of fintech companies in the region, such as GoCardless and Curve, that are set to close deals worth over $100 million before the end of 2020. These may push the overall investment figure for Q4 2020.

Top 3 European VC Deals from Jan-Oct 2020 Worth a Combined $1.7 Billion

Q2 2020 saw a total of €1.7 billion in funding value despite a brief blip in March. And in Q3 2020, the figure shot up to €2.6 billion. According to McKinsey, the same period in 2019 saw a total of €5.6 billion.

In H1 2020, London received the highest amount of investment, €1.7 billion or 57% of the total capital invested. Berlin was second with €366 million and Paris third with €351 million.

During the first ten months of 2020, the highest value VC deal in Europe’s fintech sector was Klarna’s $650 million funding. N26 was second at $570 million while Revolut’s $550 million placed it in the third spot. Interestingly, the fourth highest value deal was worth less than a third of the previous one, which was Checkout.com’s $150 million funding.

According to Dealroom, fintech is the largest investment category for Europe. Between the start of 2014 and October 2020, the sector had received more than €30 billion worth of investment. Health followed closely behind with €29 billion and enterprise software was third with €27 billion.

US Accounted for 60% of Global Funding Value in October 2020

Globally, fintech startups raised a total of $3 billion across 208 VC/PE funding deals in October 2020 according to GoMedici.

Compared to September 2020 when the total global funding value reached $6.59 billion, this marked a 54.4% decline. Similarly, there was a 19.6% month-over-month (MoM) decline in the number of transactions, down from 259 in September.

The US took the lead during the month, with a 59.8% share of global funding value. In spite of the economic downturn resulting from the pandemic, investor interest in US fintech companies has remained strong.

According to S&P Global, US funding in the sector is on track to end 2020 with a higher amount and volume of funding than it did in 2019. During H1 2020, US-based startups within the space raised 30.2% more than they did in a similar period in 2019. Similarly, the number of transactions was 14.2% higher year-over-year (YoY).

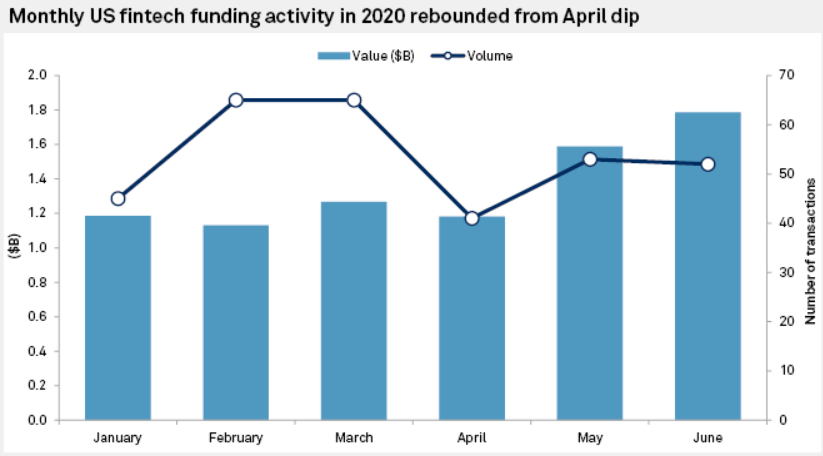

In spite of the pandemic’s grip, April only saw a modest decline in funding value and by May, the figure had shot up above any preceding month in 2020.

Notably, Stripe Inc.’s Series G round that took place in mid-April raising around $600 million helped to keep funding value up during that month. Its exclusion from the total would have meant a 56.5% MoM decline compared to March.

The situation was vastly different in Asia Pacific. S&P Global data shows that during the first nine months of 2020, fintech companies in the region raised a cumulative $3.9 billion across 318 deals. Compared to a similar period in 2019, this marked a 46% decline YoY in deal value while deal volume fell by 20.5% YoY.

In Q3 2020 alone, they raised a combined $1.3 billion, down 8.7% from the figure posted in Q2 2020. Looking at monthly figures, however, the slump seems to have hit a trough in June as both the funding value and volume have been rising since then.

Question & Answers (0)