The year 2020 is set to be a banner industry for investments in the digital health industry. From Q1 to Q3, the sector has seen nearly $10 billion in investments.

According to the research data analyzed and published by Comprar Acciones, in the nine-month period, the digital health industry outpaced the total investment value it got in 2019 which was $7.4 billion. With three months to go, the figure far eclipsed the previous figure of the highest annual funding, which was $8.2 billion in 2018.

During Q1 2020, there were a total of 82 deals worth a cumulative $2.9 billion. The volume was slightly higher in Q2, with 89 deals in all, but their value was lower, at $2.4 billion.

It is noteworthy that the total funding for each of the quarters was significantly higher than the $2.1 billion quarterly average.

For Q3 2020, both the value and volume were unprecedented, with 109 deals valued at a cumulative $4.6 billion. That was three times the figure reported in Q3 2019 when investors poured in $1.55 billion on 66 deals in the sector.

Funding value grew by an impressive 58.62% between Q1 and Q3 2020. Deal volume also rose significantly, increasing by 22% during the nine-month period. The surge in funding for the sector was attributed to the pandemic, as it led to a reduction in conventional health services. In most parts of the globe, in-person appointments were limited to critical medical conditions.

As a result, there was a spike in practice like remote monitoring, telehealth and digital innovations in the sector. In turn, there was an acceleration in investments going into the digital health space.

Average Deal Size Hits $30.2 Million, 1.5x Higher than 2019

The first nine months of 2020 saw large deals driving the numbers. The average deal size was $30.2 million, around 1.5 times higher than the 2019 average which was $19.7 million.

During Q3 2020, 24 companies in digital health were involved in mega deals, raising $100 million or more according to Rock Health. That was double the previous annual record which was set in 2018 with 12 mega deals.

For the period between the start of January and end of September 2020, mega deals accounted for 41% of total funding in the digital health sector.

Bright Health topped the list with the largest deal, valued at $500 million. It was raised in a Series E round whose investors included Tiger Global and Blackstone among others.

Zwift raised the second highest amount during the period with a total of $450 million in a Series C round. XtalPi was third with $319 million in its Series C while Classpass came in fourth with $285 million in Series E.

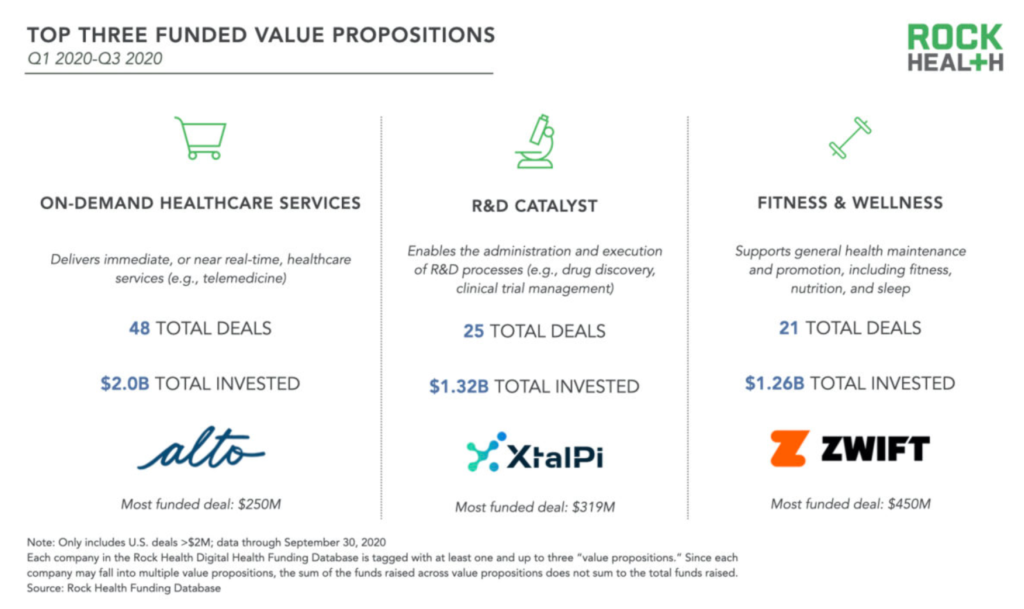

On-Demand Healthcare Segment With 48 Deals Worth $2 Billion

Since the start of the year, there was an increase in on-demand healthcare. This was the most funded value proposition and the category with the highest number of deals. The segment includes at-home urgent care, telemedicine and prescription delivery.

From Q1 to Q3 2020, there were 48 deals in this segment attracting a total of $2.0 billion. Top on the list of deals in this category was Alto Pharmacy, which attracted $250 million for its free prescription delivery service.

Ro was second, raising $200 million for its virtual consultation business. AmWell, a telemedicine service took the third spot, raising $194 million. Notably, AmWell went public in September 2020, selling 41.2 million shares at $18 per share, raising $742 million. According to its SEC filing, both the number of shares and price per share were higher than initially intended.

Average deal size in on-demand healthcare was also considerably higher than in the sector as a whole. At $42.1 million, it was 40% larger than the overall average.

The second most funded value proposition in Q1 to Q3 2020 was research and development (R&D). There was a total of 25 deals in this category, raising a cumulative $1.32 billion. Average deal size in the segment was $52.7 million, 75% higher than the overall average. While it had the second highest deal value, it was the seventh largest segment by the number of deals.

There was also a high concentration of capital in companies under the fitness and wellness category. It was the third most funded category with 21 deals valued at a total of $1.26 billion. The average deal size was $59.9 million, 99% higher than the overall sector average.

In 2019, on-demand healthcare and fitness and wellness services were among the top-funded segments. Lockdowns have only served to increase demand in these categories. However, the high concentration of capital in R&D represents a huge shift, as this was the seventh most highly funded segment in 2019.

Question & Answers (0)