The year 2020 saw the world develop a growing hunger for alternatives to dining out due to shelter-in-place orders. The global online food delivery market was worth $136.43 billion in 2020. It was a significant change over 2019’s $107.44 billion.

According to the research data analyzed and published by Comprar Acciones, the worldwide uptrend is expected to continue in 2021 with revenue projected to reach $151.53 billion, an 11.1% increase year-over-year (YoY).

In the US, which is the world’s second largest online food delivery market, it is projected to grow by 7.4% YoY in 2021. This would push its total online food delivery revenue for the year to $28.49 billion.

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(“script”);o.async=1,o.id=n,o.src=”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

Restaurant-to-consumer delivery is the top market segment, expected to generate $16.56 billion in 2021.

For a bit of perspective, the online delivery market in the US was worth $19.47 billion in 2019. At the time, the platform-to-consumer segment raked in $6 billion while restaurant-to-consumer generated $13.47 billion.

In the period between 2021 and 2024, the US market is set to grow at a 4.3% CAGR to reach $32.33 billion by 2024.

US Food Delivery Penetration to Rise from 9% to 21% in 2025

Based on a study by Morgan Stanley, the US online food delivery penetration rate was at 9% in 2019 pre-pandemic. But it rose to 13% in 2020 and could go as high as 21% by 2025.

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(“script”);o.async=1,o.id=n,o.src=”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

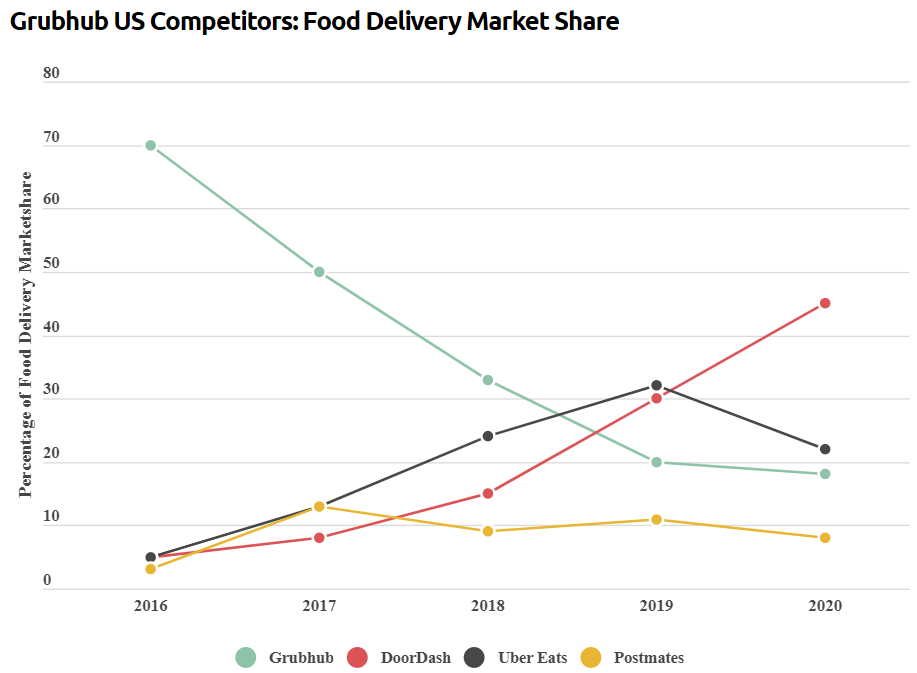

Over the past several years, a handful of top players have dominated the US market. These include Doordash, Grubhub and Uber Eats. According to Statista’s data, the three collectively held a 70% market share in 2018.

Grubhub was the top player with a 55% market share in 2018, but steadily lost to DoorDash and Uber Eats according to Vox.

As of October 2020, DoorDash was in the lead with a 45% market share according to Business of Apps. Uber Eats had a 30% share, while Grubhub had slightly less than 20%.

DoorDash progressively grew from a market share of about 13% in 2018 to take the top position in the competitive market. Though there were talks of a merger with Uber in 2019, the plan did not take off. The company went public in December 2020, raising $3.4 billion in a landmark IPO.

On the other hand, Uber Eats held a 17% market share in 2018 and has been relatively consistent over the years. Its $2.65 acquisition of Postmates, completed in November 2020, boosted its position significantly, adding more than 10% to its overall share.

After failing to acquire DoorDash, Uber Eats approached Grubhub with an acquisition offer. However, it lost out to European company Just Eat Takeaway, which launched a $7.3 billion bid that Grubhub accepted in June 2020.

Two months prior to that, Just Eat got approval for a $7.6 billion merger deal with Takeaway.com. The deal is set to close during the first quarter of 2021 and will create the largest food delivery company globally outside China.

Founded in the early 2000’s, the two companies were among the earliest arrivals in the market. In 2019, they cumulatively processed 593 million restaurant orders and had a combined user base of 70 million.

Due to the pandemic in 2020, Grubhub saw its number of orders grow by 28% in April and May. During the same period, Just Eat Takeaway had a 41% uptick in orders.

Grubhub’s Exclusive Customers Drop from 71% to 49%

Consolidation is a constant in the US online food delivery industry. In addition to the aforementioned acquisitions, DoorDash bought Caviar in 2019 for $410 million.

Part of the reason for the wave of consolidations is that customers are not loyal to any single service. Grubhub CEO once termed these “promiscuous customers” as a hindrance to his company’s success.

Based on a Second Measure report, 71% of Grubhub customers did not use any other food delivery services in 2018. But in Q3 2020, the figure had dropped to 49%. DoorDash had 53% exclusive customers during the quarter, while Uber Eats had 43%.

37% of Grubhub and 40% of Uber Eats customers also ordered from DoorDash in Q3 2020. At the same time, 27% of DoorDash and 28% Uber Eats customers also ordered from Grubhub. And 20% of Grubhub and 21% of DoorDash customers also ordered from Uber Eats.

As a result, delivery services are securing partnerships with top restaurants in the country. For instance, DoorDash has partnered with 34,000 restaurants in the US and is available in 4,000 cities.

Prior to its merger with Uber Eats, Postmates had 600,000 merchants and offered services in 4,200 cities. Uber Eats, on the other hand, had 500,000 partner restaurants and served 1,000 cities. Grubhub had 300,000 restaurants on its food delivery app and served 4,000 cities.

Question & Answers (0)