SaaS and subscription revenue of VMware surpassed its on-premises license revenue for the first time in its Q3 fiscal year 2021 which ended in October 2020.

According to the research data analyzed and published by Comprar Acciones, VMware’s SaaS and subscription revenue totaled $676 million. That translated to an increase of 44% year-over-year (YoY) and accounted for 24% of the company’s total revenue. During the same period, on-premises license revenue amounted to $639 million.

In the past, VMware got most of its revenue from the sales of on-premises data center software. But in recent years, it has initiated a gradual transition to the cloud.

The unique business circumstances occasioned by the pandemic served to speed up the cloud-first shift. This was the result of large enterprise customers reducing on-premises spending and spending more on cloud-delivered models in support of remote work.

VMware’s total revenue for Q3 FY21 was $2.86 billion, up by 8% YoY. Its profit for the period was $704 million, equivalent to $1.66 per share. That was a 17% increase YoY from the $602 million profit or $1.42 per share in Q3 of the year-ago period.

SaaS Spending to Grow to $140 Billion by 2022 from $102 Billion in 2019

For the IT industry as a whole, spending is continually shifting to public cloud computing. According to a Gartner report, it is estimated that by 2024, 45% of IT spending will shift to the cloud from traditional solutions.

The latest IT spending forecast from Gartner projects that spending on data center systems will decline by 10% in 2020, to reach $188 billion. On the other hand, it estimates that spending on cloud system infrastructure services will go from $41 billion in 2019 to $63 billion in 2020. By 2022, it is expected to reach $81 billion.

Similarly, Gartner anticipates that SaaS solutions will generate $104.7 billion in 2020, up from 102.1 billion in 2019. The figure is expected to grow to $121.0 billion in 2021 and further to $140.6 billion in 2022.

It is worth noting that in Q1 2020, on-premises IT spending dropped by 16.3% YoY according to IDC. In contrast, public cloud spending surged by 6.4% YoY and was the only deployment segment to escape a YoY drop during that period.

Overall cloud spending grew by 2.2% due to a 6.3% decline in private cloud infrastructure spending. At the time, IDC predicted that IT spending would keep soaring and by the end of 2020, would account for 54.2% of overall IT spending.

Moreover, in Q2 2020, there was an 8.7% YoY decline in traditional IT spending, while overall cloud spending increased by 34.4% YoY. Public cloud spending surged by 47.8% YoY during the period while private cloud spending increased by 7%.

According to Canalys, global spending on cloud services rose by 33% YoY in Q3 2020, reaching $36.5 billion. It was $2.0 billion higher than Q2 2020 and $9 billion higher than Q3 2019.

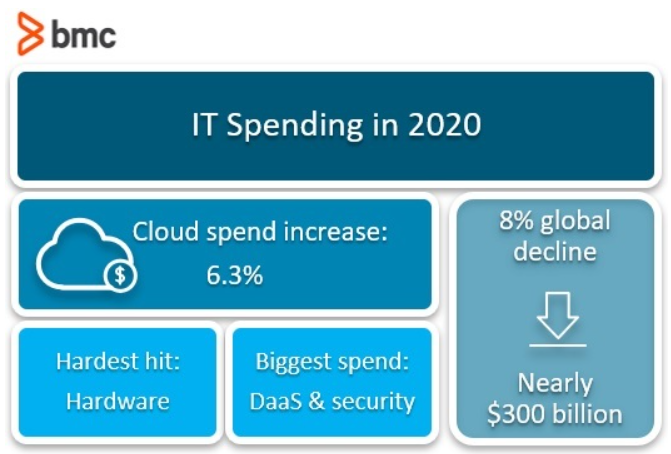

Global IT Spending to Shed $300 Billion in 2020 as Cloud Spending Surges 6.3%

Gartner projects that the global IT spending will decline by 8% YoY in 2020 to $3.5 trillion. Comparatively, the figure was $3.8 trillion in 2019, which means that the drop will be a massive $300 billion.

Cloud spending will, however, be a bright spot in the industry as it is projected to grow by 6.3% YoY.

While SaaS is the largest segment of cloud solutions and is expected to remain so up to 2022, its growth rate is expected to slow down. Over a five-year period, the segment is expected to grow at a 12% CAGR according to BMC.

Comparatively, the total cloud market will grow at a CAGR of 12.5%. Initially immature technologies like Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) will outperform the overall sector. IaaS is anticipated to have the highest growth rate at 18% CAGR while PaaS is estimated to grow at 17.2% over the five-year period.

In terms of revenue though, SaaS will remain miles ahead as PaaS is set to reach $72.0 billion in 2022, about half of SaaS. IaaS will be slightly higher than PaaS, with about $81.0 billion.

According to research data published by BMC, by 2021, 73% of organizations will be using SaaS solutions wholly or in part. In fact, 85% of small companies had already invested in SaaS solutions at the end of August 2020.

Lastly, an IDG report highlights the overall growth of cloud computing. It highlights that 92% of organizations operate their IT environment in the cloud to some extent. By the start of 2022, the figure is expected to have increased to 95%.

Question & Answers (0)