For the European hospitality industry, substantial effects of the pandemic are expected to affect its performance in 2021. According to the research data analyzed and published by ComprarAcciones.com, revenue could slump by as much as 50% during the year.

Various reports attribute this potentially dismal performance to the fact that the hotel industry will be among the last to recover. A full recovery could, in fact, happen in 2023 or take years as travel restrictions and the need for social distancing continue to take a toll.

Based on a study by S&P Global, the next few years could see a drop of 10% to 30% in business travel. As such, hotels that cater to conferences and large groups are set to recover last once the pandemic is under control.

Hotel landlords in the European region have been among the top losers since the onset of the pandemic and will continue to lose through the first half of 2021. In that period, they are projected to lose an average of 50% to 80% of variable rent and 15% to 30% of fixed lease income.

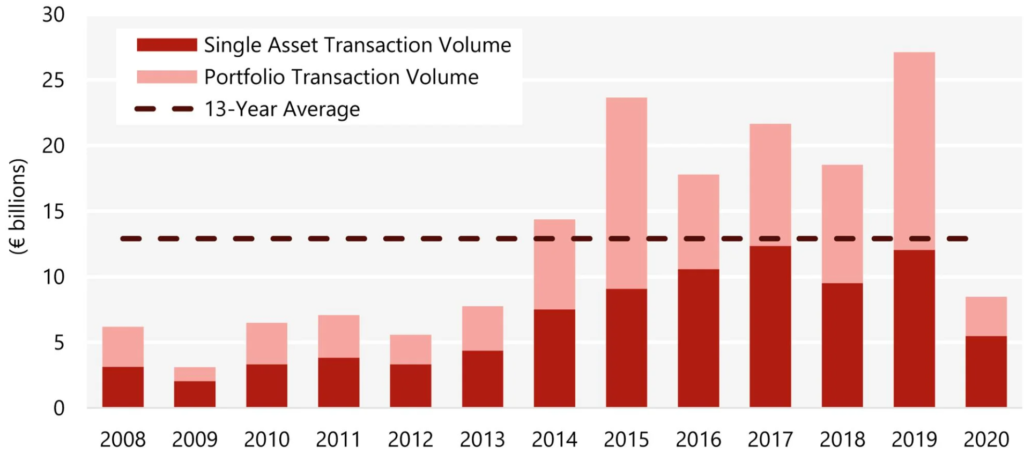

According to HVS, the European hotel sector suffered an enormous hit in 2020 but the outlook remains positive in the long term. A report by the global hotel consultancy reveals that the sector’s transaction volume reached €8.5 billion in 2020.

Compared to the 2019 figure, which was a peak of €27.1 billion, that marked a 69% decline. However, the figures were significantly ahead of those recorded during the Global Financial Crisis in 2009. During that year, transaction volume amounted to a mere €3.1 billion in the region.

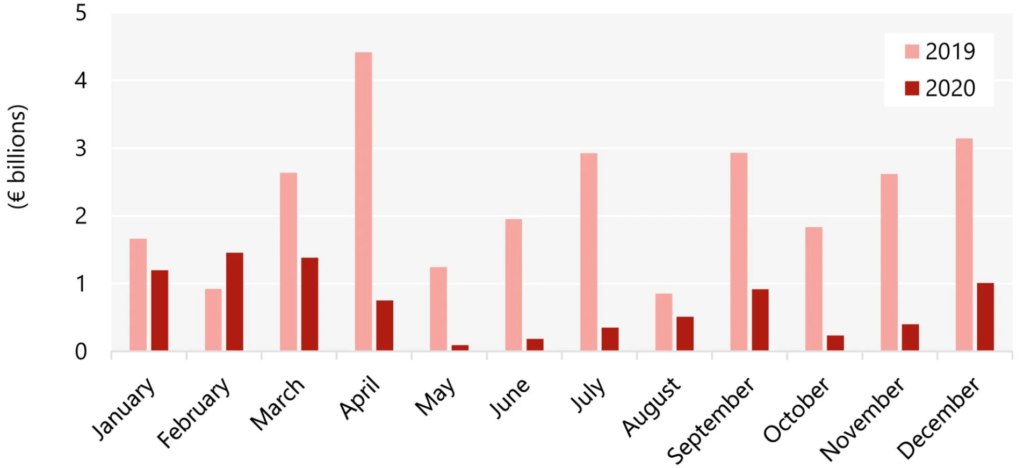

48% of 2020 Transaction Volume Took Place in Q1 2020

It is worth noting though that 48% of the transaction volume posted in 2020 took place in the first quarter. 2020 was primed to be a great year as transaction volume in January and February hit €2.7 billion, 2.5% higher than the corresponding period of 2019.

The average sale price per room during the period shot up by 1.8% to €170,000. By mid-March, however, the situation took a dire turn as hotels closed amid national lockdowns. For those that remained open, there were top-line declines of over 80%.

The total number of transactions during the year fell by 66% to 291 for the whole year. Average sales price per room dropped by 6% while the number of rooms per transaction fell by 4%.

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(“script”);o.async=1,o.id=n,o.src=”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

The UK led Europe in terms of annual transaction volume, reaching €2.1 billion, a 61% year-over-year (YoY) drop. Germany was second with €1.7 billion, 57% lower than 2019.

London had the highest investment volume in European cities, coming in at €1.6 billion, down by 27% YoY. Munich took second place with €501 million, up by 15% YoY, while Paris was third with €312 million, marking a 51% YoY decline.

During the first half of 2021, it is expected that there will still be little transactional activity as lockdowns and travel bans remain in place in most of Europe. But as countries collectively ease travel bans and the vaccine rollout continues, the industry will initiate a recovery.

The European hotel industry’s transaction volumes are expected to start recovering in H2 2021. Hotel revenue streams are, however, likely to take a bit longer, beginning to rise in 2022.

European Accommodation Turnover to Surge by 28% in 2021 Yet Remain 39% Below 2019 High

Stakeholders in the hospitality industry have been hoping for a rebound during summer of 2021. However, with travel restrictions remaining in place, the outlook still remains bleak.

According to Allianz analysts, the European independent hotel sector will only regain a quarter of its 2020 declines this summer. Based on its estimates, sales for the sector fell by 50% in 2020.

Based on Goldman Sachs’ projections, if restrictions remain through summer, Southern Europe will lose up to 1.3% of GDP growth.

The slump in tourism seen during summer 2020 wreaked havoc on the European economy. In Spain, foreign tourist income during the peak period between July and September fell by 78% YoY according to a recent Bank of Spain estimate.

In a typical year, tourism accounts for a share of about 12% of Spain’s GDP. However, as a result of the contraction in 2020, the country’s GDP fell by 11%. That was the highest decline in all of Europe.

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(“script”);o.async=1,o.id=n,o.src=”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

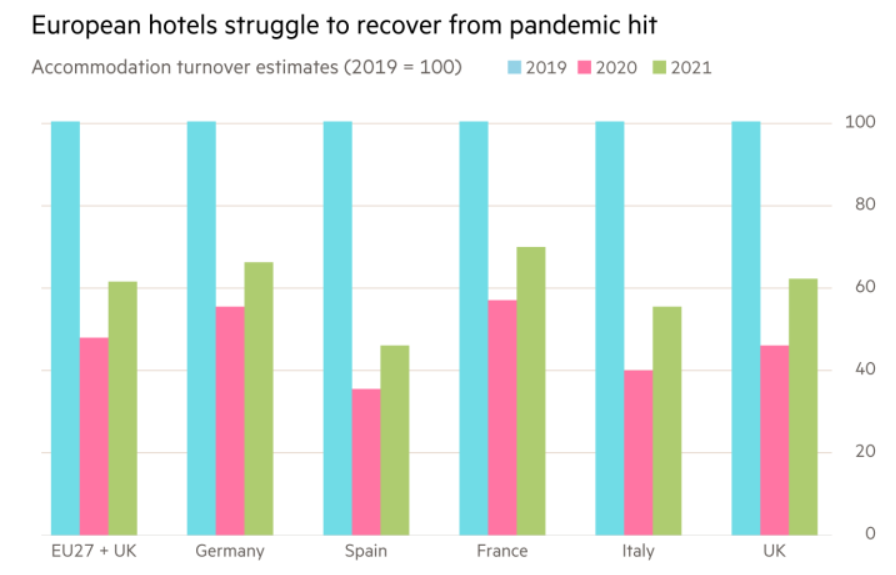

For the whole of Europe, there was a loss of €115 billion in accommodation turnover in 2020 according to Euler Hermes. Because of the poor performance seen in Q1 2021, the annual recovery is expected to be patchy and partial.

However, with the region progressively lifting restrictions, demand should rise significantly during the crucial summer period. Annual turnover for 2021 could rise by 28% in Europe but will still be around 39% lower than the 2019 high.

Question & Answers (0)